Our ownership structure

Articles of Association

The Company’s Articles of Association also set out rules governing the Board, its directors, and shareholders. Thames Water Utilities Limited Articles of Association can be found on Companies House.

Our structure

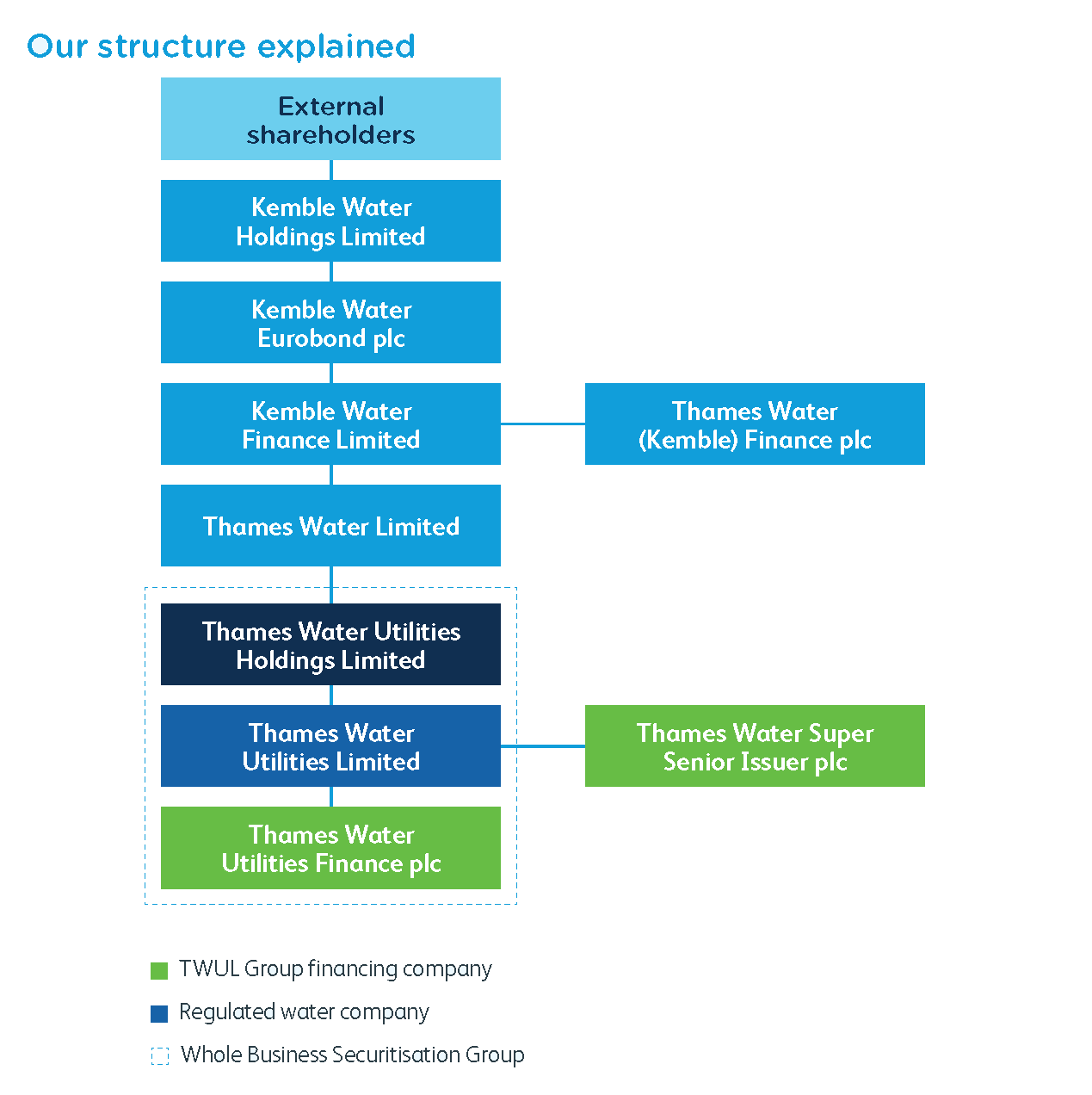

The chart below sets out the ownership of Thames Water and those group companies that connect Kemble Water Holdings Limited, our ultimate parent company, to the regulated company, Thames Water Utilities Limited.

Thames Water Utilities Limited (“Thames Water” or “TWUL”) is the regulated, licensed operating company which provides essential water and wastewater services to customers across London, the Thames Valley and Home Counties.

Kemble Water Holdings Limited is owned by a consortium of institutional shareholders – mostly pension funds and sovereign wealth funds.

A simplified structure is set out here. All the companies in this structure are incorporated in the UK, in accordance with the Companies Act 2006, and are also registered for tax with HMRC.

Thames Water has a “whole business securitisation” that ringfences it from the rest of the Kemble Group. This provides a stable debt platform to fund TWUL from a variety of sources and includes a comprehensive set of covenant and security arrangements.

Here we outline the other companies within our group:

Kemble Water Holdings Limited

This is the ultimate company of the Group, set up in 2006 for investors to hold shares in the Group.

Kemble Water Eurobond plc

This was originally set up to raise debt from shareholders to help buy TWUL in 2006.

Kemble Water Finance Limited

This was originally set up to raise debt from external lenders to help buy TWUL in 2006. External lenders require greater security than shareholders, so their debt is held in a separate company, which is closer to TWUL.

Thames Water Limited

This was at one point listed on the London Stock Exchange. Now it holds pension obligations and other non-regulated companies.

Thames Water Utilities Holdings Limited

This was set up in 2007 for the whole business securitisation (WBS), and provides security to WBS lenders over the shares in TWUL.

Thames Water Utilities Finance plc

This raises debt to fund TWUL.

Thames Water Super Senior Issuer plc

This raises super senior debt to fund TWUL.

Kemble Water Holdings Limited's external shareholders

| Who | How much | What they do | When |

|---|---|---|---|

| Ontario Municipal Employees Retirement System | 31.777% | One of Canada’s largest pension plans, with C$105 billion of net assets and global experience managing essential infrastructure | 2017-2018 |

| Universities Superannuation Scheme | 19.710% | A UK pension scheme for the academic staff of UK universities | 2017, 2021 |

| Infinity Investments SA | 9.900% | A subsidiary of the Abu Dhabi Investment Authority and one of the world’s largest sovereign wealth funds | 2011 |

| British Columbia Investment Management Corporation | 8.706% | An investment management services provider for British Columbia’s public sector | 2006 |

| Hermes GPE | 8.699% | One of Europe’s leading independent specialists in global private markets | 2012 |

| China Investment Corporation | 8.688% | One of the world’s largest sovereign wealth funds | 2012 |

| Queensland Investment Corporation | 5.352% | A global diversified alternative investment firm and one of the largest institutional investment managers in Australia | 2006 |

| Aquila GP Inc. | 4.996% | A leading infrastructure management firm and a wholly owned subsidiary of Fiera Infrastructure Inc., a leading investor across all subsectors of the infrastructure asset class | 2013 |

| Stichting Pensioenfonds Zorg en Welzijn | 2.172% | A pension fund service provider managing several different pension funds as well as affiliated employers and their employees | 2006 |

Learn more about our performance and our debt investment information.